Skrill eWallet – Fast and Secure Online Payments

What is Skrill eWallet?

Skrill eWallet is an online payment service that allows individuals and businesses to securely send and receive money online. Skrill was founded in 2001 and has since grown into a popular payment platform that supports over 40 currencies and is available in over 200 countries worldwide.

Why Skrill eWallet is so important in Forex and Binary trading

Easy deposits and withdrawals: Skrill makes it easy to deposit and withdraw funds from forex and binary trading accounts. Many forex and binary brokers accept Skrill as a payment option, and deposits and withdrawals can be processed quickly and securely.

International payments: Skrill supports over 40 currencies and is available in over 200 countries, making it a convenient option for traders who operate in multiple currencies or who live in countries where other payment options may not be available.

Security: Skrill uses advanced security measures to protect user data and transactions, such as 2-factor authentication and SSL encryption. This gives traders peace of mind knowing that their funds are secure and protected.

Low fees: Skrill offers competitive fees for forex and binary traders, with low fees for transactions and currency conversions. This can help traders save money and maximize their profits.

Easy to use: Skrill is easy to use, with a user-friendly interface and simple payment processes. This can save traders time and hassle when making deposits and withdrawals, allowing them to focus on their trading activities.

Overall, Skrill is a convenient, secure, and cost-effective payment option for forex and binary traders, and is widely used by traders all around the world.

What can we do through Skrill?

Skrill eWallet offers a range of services to its users, including:

- Send and receive money: Skrill allows users to send and receive money to and from other Skrill users, as well as to bank accounts and mobile wallets.

- Online shopping: Skrill can be used to make online purchases from thousands of merchants worldwide.

- Cryptocurrency trading: Skrill also offers cryptocurrency trading, allowing users to buy, sell, and hold various cryptocurrencies.

- Forex Trading: Neteller can be used to fund your forex trading account.

- Binary Option Trading: Neteller can be used to fund your forex trading account.

- Provides Prepaid Mastercard: Skrill offers a prepaid Mastercard that can be used to make purchases at millions of locations worldwide, as well as to withdraw cash from ATMs.

Skrill available countries

Skrill is available in over 200 countries worldwide, including the US, UK, Australia, Canada, and many European countries. However, Skrill’s services may be restricted in certain countries due to local regulations or other factors.

Skrill supported services and shops:

Skrill can be used to make purchases at thousands of online merchants worldwide, including gaming sites, e-commerce sites, and other businesses. Skrill is also accepted by a growing number of physical merchants, including shops and restaurants.

How to create a Skrill account:

In this section , We have provide a simple guide , click on the following link to visit complete Skrill account creation and verification guide.

Skrill account creation and verification full steps guide

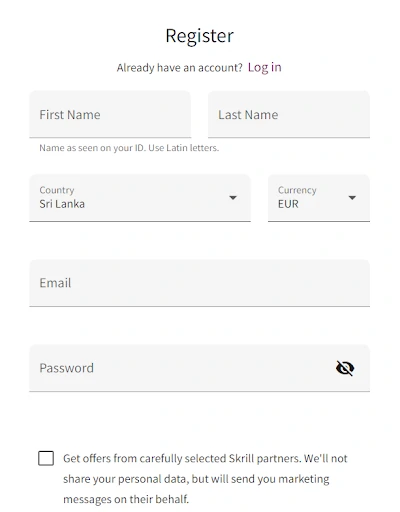

To create a Skrill account, follow these steps:

- Step 1 : Go to the Skrill website and click “Register” in the top right corner.

- Step 2 : Enter your personal information, including your name, address, and email address.

- Step 3 : Choose a password and select your account currency.

- Step 4 : Verify your email address by clicking the verification link that is sent to you.

- Step 5 : Add a payment method, such as a credit card or bank account, to fund your account.

- Step 6 : Once your account is funded, you can start using Skrill to send and receive money, make purchases, and more.

Skrill may require additional verification steps, such as providing a government-issued ID or proof of address, depending on your location and account activity.

How to Verify Skrill account

In this section , We have provide a simple guide , click on the following link to visit complete Skrill account creation and verification guide.

Skrill account creation and verification full steps guide

To verify your Skrill account, you may need to complete some or all of the following steps, depending on your location and account activity:

- Step 1 : Verify your email address: Skrill will send you a verification email when you sign up. Click on the link in the email to verify your email address.

- Step 2 : Provide personal information: Skrill may require you to provide personal information, such as your full name, date of birth, and address. You may also be asked to provide a government-issued ID and proof of address, such as a utility bill.

- Step 3 : Add a payment method: You’ll need to add a payment method, such as a credit card or bank account, to fund your Skrill account. Skrill may ask you to verify your payment method by providing additional information or documentation.

- Step 4 : Complete a money transfer: Skrill may require you to complete a money transfer to verify your account. This could involve sending money to another Skrill user or making a purchase using your Skrill account.

- Step 5 : Complete additional verification steps: Skrill may require additional verification steps, such as answering security questions or providing additional documentation.

- Step 6 : Once you’ve completed these steps, your Skrill account should be verified and you’ll be able to use all of Skrill’s features and services. If you have any issues or questions during the verification process, you can contact Skrill’s customer support for assistance.

Get free support for Skrill account creating and verification

If you are having trouble creating or verifying your Skrill account, you can contact tradeszee customer support for assistance. Our customer support team is available 24/7 to help with any issues you may have. We will help you to complete your Skrill account and verify it for free.